The rules of the game have fundamentally changed.

For 40 years, we've prospered amid falling interest rates and frequent refinancing. As an industry, we've struggled for the last two years with losses and uncertainty - signaling a shift in dynamics.

Adversity often sows the seeds of opportunity, challenging us to think beyond conventional wisdom. By embracing challenges, we can uncover new paths to success and growth.

Read how Rich Weidel, Princeton Mortgage's CEO, challenges conventional wisdom and provides mortgage loan originators with a different way of thinking and winning in this market. As a result, Princeton Power Producers obtain interest rates 0.5% to 0.75% lower than the average branch pricing, translating into higher pull-through and more funded volume.

“If you challenge conventional wisdom, you will find ways to do things much better than they are currently done.”

Michael Lewis, Moneyball

1. Borrower Challenges: The American Dream in Crisis

Locked Out of Homeownership:

Despite enticingly low mortgage rates, the average American finds themselves locked out of the housing market. Homes have skyrocketed in price by 50% since the pandemic began, rendering homeownership unattainable for 99% of the nation. In 2020, an income of $50,000 was enough to buy an average home; now, that figure has doubled to $100,000, far surpassing the median household income of $78,000. This staggering reality has led to a sharp decline in existing home sales, plunging from a stable 5.4 million annually to a mere 4 million in 2023, with refinancing becoming a distant memory due to 90% of Americans having a mortgage rate under 5%.

2. Loan Originator Challenges: Plunging Income, Lost Trust

Crippling Compensation Decline:

The once-lucrative career of a loan officer has been decimated, with average compensation plummeting by a staggering 76.8% since 2021, from $251,000 to a meager $58,000 by 2023. This decline is because loan volume per originator has nosedived from $25.1 million in 2021 to a mere $5.8 million in 2023. When adjusted for inflation, this decline is even more crushing, eroding purchasing power by an additional 21% since 2020. Moreover, loan originators operate in the dark, deprived of crucial information and support, fostering a sense of exploitation within their ranks.

3. Sales Manager Challenges: The Blind Leading the Unprofitable

Branches in Peril:

In 2023, an alarming 50% of mortgage branches operated at a loss, illuminating a dire predicament at the heart of the industry. Sales managers find themselves grappling with inadequate insights into loan economics, leaving them susceptible to exploitation during the recruitment process. Without a comprehensive understanding of loan economics and the courage to act on it, their decision-making often backfires: attempts to boost profitability by raising margins result in decreased loan volume or the departure of loan originators seeking better opportunities elsewhere.

SECTION ONE:

defining the problem

Rich Weidel, Princeton Mortgage CEO

Featured at HousingWire National

"The industry has a $2,000 per loan problem."

4. Company Challenges: Conventional Wisdom Fails

Driving Off the Cliff:

Mortgage companies have been grappling with sustained financial losses for over two years, challenging conventional wisdom and undermining hopes for a swift production rebound. According to the Mortgage Bankers Association, the average net loss per loan originated was a staggering $2,109 in the fourth quarter of 2023. Despite robust production revenue per loan ($10,376), soaring production expenses ($12,485) have outpaced revenue, driving sustained losses across the industry.

-

Conventional Wisdom Falters: Traditional strategies and industry norms have fallen short in driving positive results. The once-reliable playbook for success has proven ineffective in the face of evolving market dynamics.

-

Elusive Production Rebound: Optimism for a rebound in production grows increasingly distant as inflation persists and mortgage companies grapple with persistent financial losses. Industry stakeholders face a daunting task in adapting strategies to thrive in this challenging climate.

These financial strains are pervasive, impacting mortgage companies of all sizes, from large enterprises to smaller firms. The industry's struggle to navigate this cycle underscores the depth of the crisis and highlights the urgent need for innovative solutions to revive profitability and sustainability.

SECTION TWO:

how we got here

The Impact of a Declining Interest Rate Environment

For over four decades, the mortgage industry thrived in a landscape of steadily declining interest rates, marked by periodic waves of refinancing activity. This environment fostered consistent profitability and became the cornerstone of the industry's business model for many years.

However, beneath the surface of this prolonged era of low interest rates, fundamental vulnerabilities within the industry began to emerge. These vulnerabilities came into sharp focus over the past two years as the mortgage industry grappled with persistent unprofitability and uncertainty, with no clear end in sight. The rules of the game have fundamentally changed.

The Mortgage Bankers Association (MBA) began tracking industry profitability in 2003, and until recently, the only unprofitable quarter was Q1 of 2014, when lenders incurred a loss of $194 per loan due to compliance costs associated with Dodd-Frank reform.

The tipping point arrived in 2018 when the 10-year US Treasury (10YT) Rate surged from 2.40% in July 2017 to 3.12% in July 2018, triggering the industry's first significant loss of profitability. By Q4 of 2018, mortgage profitability hit an unprecedented low of -$200 per loan, marking only the third instance of the mortgage industry reporting a loss per loan since 2003. The second instance occurred in Q1 of 2018, with a loss of $118 per loan. In Q4 of 2023, the loss per loan was $2,109, 10x the previous largest loss.

Unfortunately, this respite from crisis in 2019 postponed necessary business model changes, leading to repercussions in 2022. The industry's struggle to adapt underscores the systemic impact of operating within a declining interest rate paradigm for an extended period. The prolonged low-interest-rate environment has left the industry ill-prepared for a market where interest rates are rising, challenging the sustainability of traditional business models.

SECTION THREE:

the failure of conventional wisdom

Acknowledging the Problem:

The first step towards recovery is admitting there's a problem. The mortgage industry faces an enduring structural challenge:

-

Loan originator earnings have plummeted by 76.8%.

-

Mortgage company costs exceed revenues by $2,500 per loan.

Two Options:

-

Hope to survive until production rebounds.

-

Take proactive steps to address the issue.

In many companies, the approach to addressing these challenges often follows a familiar pattern:

Board Meeting:

Company Board: "We've been losing money for two straight years. What's the plan?"

CEO: "I'm working on it and bringing in consultants."

First Meeting with Consultant:

Consultant: "I've analyzed your numbers, and you're losing money on every mortgage.

What ideas do you have?"

CEO: "Close more loans."

Consultant: "But that will only lead to more losses."

CEO: [remains silent and resorts to offering larger signing bonuses to loan originators

with frequent job changes]

And we’ve all heard the following recruiting pitch, "Join our company. We offer the best support, lowest rates, highest compensation, and cutting-edge tech. Work less and earn more! We have the secret sauce."

If only. If a company figured that out, every loan originator in the country would flock to them.

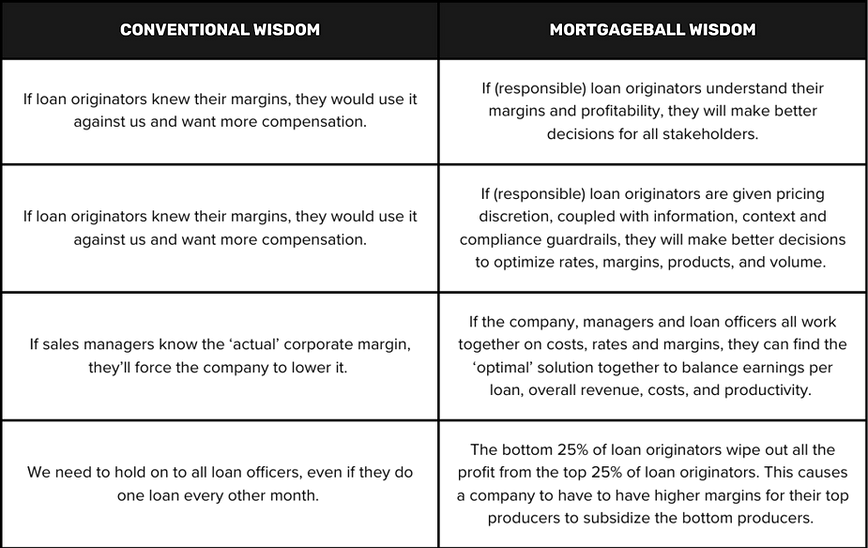

Conventional wisdom has led us to a state of:

-

Loan officers earning less.

-

Mortgage companies hemorrhaging money.

-

Increasing distrust between loan originators and companies.

What worked over the last four decades of declining interest rates can’t and won’t work today.

SECTION FOUR:

mortgageball

“If you challenge conventional wisdom, you will find ways to do things much better than they are currently done.” - Michael Lewis, Moneyball

Example: Power Producer Model vs. Traditional Model

Scenario 1 (The Traditional Model) is an example of a Loan Originator who generated $85,000 of total revenue from 10 loans. The total margin was 409 bps, and the revenue per loan was $9,652.

TRADITIONAL MODEL

Conventional wisdom would celebrate this outcome. The producer is holding high margins (409 bps).

But is that the best outcome for everyone? What would happen if the producer was given total pricing and margin transparency coupled with autonomy?

The outcome was that the total margin decreased 124 bps, from 409 bps to 285 bps:

%20(2).png)

SECTION FIVE:

results

This is a huge win! The producer brought in the same revenue ($85,000), but the revenue per loan increased by $3,762, while the total margin decreased by 124 bps.

-

The loan originator made more money ($32,990 vs $23,852);

-

The borrower got better rates (total margin of 2.85% vs 4.09%)

-

The company increased the per unit profitability (more revenue per unit, fewer units)

That’s the WIN FOR ALL!

Information is Power.

That's why many companies withhold information to maintain control. We chose to work with responsible individuals who use information to grow the pie for everyone, rather than for personal gain at others' expense.

Step 1: Provide loan originators with comprehensive information about loan economics, contribution margins and their profitability. Coach and train to help loan officers improve their profitability, and thus earning potential.

Step 2: Empower loan originators with significant pricing flexibility within compliance guardrails.

Step 3: Freedom is the prize of responsibility, accountability is its cost. Only share with people who are deserving of Freedom and Power.

The Result: A Win for All

-

Informed loan originators make better decisions on pricing, products, and markets.

-

Sales productivity increases.

-

Fixed sales costs per loan decrease.

-

Better rates are offered to borrowers.

-

Increased volume drives higher earnings for loan originators, sales managers, and the company.

A NEW MODEL FOR A

new normal.

It's time we challenge conventional wisdom. See if the Power Producer model is the best fit for you.

Princeton Power Producers know how to win in this market.

They are efficient operators with a lower-than-market average cost per funded loan. As a result, Princeton Power Producers can obtain interest rates on average 0.5% to 0.75% lower than the average market pricing. This translates into higher pull-through and more funded volume allowing them to win more, produce more, serve more and earn more.

Are you ready to:

-

See the actual dollar amounts each mortgage rate earns, so you understand exactly how your income is generated.

-

Use detailed financial reports to set your rates strategically, ensuring maximum profitability without guesswork.

-

Ensure rates are tailored to your unique performance metrics, not averaged across less efficient peers.

-

Streamline processes and directly benefit your bottom line.

.png)